Every investment carries some level of risk. But let’s face it: the word “risk” can feel daunting. Does it mean losing all your money? Or does it simply mean accepting that returns won’t always go as planned? The truth lies somewhere in between, and this guide is here to demystify the concept.

These risks fall into two broad categories: market-wide risks, which affect entire sectors, and specific risks tied to individual companies or industries. Managing risk doesn’t mean avoiding it entirely, it’s about how you balance risk and reward to achieve your financial goals over time.

Rising inflation eats into returns, market volatility creates sudden price swings, and geopolitical tensions disrupt entire sectors. Investors who fail to account for these factors may put their financial goals at risk.

Navigating this can be a daunting task, especially when considering the various investment risks for beginners.

In this comprehensive guide, we’ll demystify the different types of investment risks, explain their potential impact on your portfolio, and provide practical strategies to mitigate them, focusing on the balance between risk and return in investing.

Key takeaways

- Investment risk refers to the potential deviation from expected returns, including the possibility of losing part or all of your investment.

- Systematic risks, such as market and political risks, are market-wide and largely unavoidable. However, unsystematic risks, specific to individual companies or industries, can often be mitigated through diversification.

- A comprehensive approach to managing risk balances return potential with risk exposure, tailored to individual financial goals, time horizons, and risk tolerance.

- Factors like inflation, interest rate changes, and liquidity constraints can significantly impact investment returns, especially over the long term.

- Tools like the Mintos Risk Score provide investors with insights into the risks associated with specific opportunities, supporting informed decision-making. However, they should complement, not replace, personal research and professional advice.

- Every investor has a unique risk appetite, influenced by age, financial situation, and investment objectives, which should guide their strategy.

- Effective risk management strategies include diversification, asset allocation, regular portfolio reviews, and maintaining an emergency fund for unexpected expenses.

1. What is an investment risk?

2. Risk and investing

3. Types of investment risks

Market risk

Credit risk

Liquidity risk

Interest rate risk

Inflation risk

Currency risk

Political risk

4. How to assess and determine your risk tolerance

5. Other tools for assessing investment risk

6. Strategies to manage investment risks

What is an investment risk?

Investment risks refer to the potential for financial loss or underperformance associated with various types of investments. These risks arise from different investment risk factors that can affect the value of your investments, leading to deviations from expected returns. Investment risk is the chance that you don’t achieve the return you expected — including the possibility of losing some or all of your invested funds.

At its core, an investment risk is the uncertainty regarding the returns on your investment. This uncertainty can be influenced by various factors, including economic changes, market fluctuations, and specific events related to individual investments or broader financial systems.

Discover smart investment strategies

Risk and investing

Investment risk is the chance that you don’t achieve the return you expected – including the possibility of losing some or all of your invested funds.

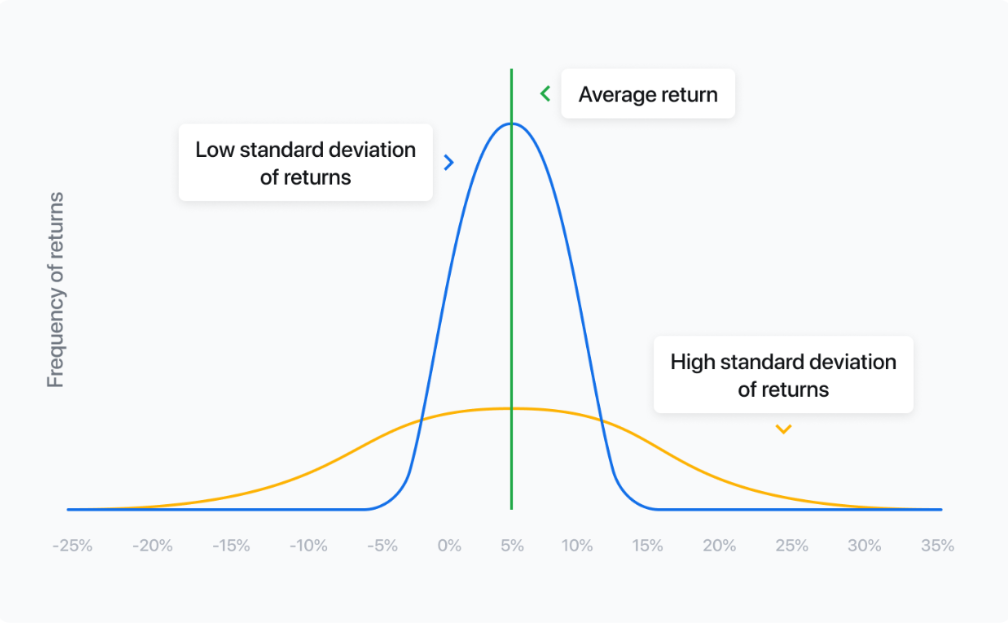

Assessing investment risk can be somewhat tricky. From a psychological perspective, it’s almost impossible to measure risk objectively; however, in finance, tools like standard deviation are used for investment risk assessment, helping investors quantify risk by examining historical performance.

By looking back at the pricing history of a particular investment, standard deviation tries to predict how much the actual return might differ from the expected return – including the chance that the return might be higher than expected.

If the price of an investment is known to change unexpectedly and often, it would be considered volatile and have a high standard deviation. When the standard deviation is high, it’s more likely that an investment’s actual return will not be as expected.

Types of investment risks

Investment risks can be broadly categorized into several types of investment risks, each with its own set of characteristics and potential impacts on your portfolio. Understanding these risks is the first step in risk management in investing.

Moreover, investment risks for beginners and experienced investors can be categorized based on their nature and source. Systematic risk (market risk) relates to the broader market and is caused by major events such as war, political instability, recessions, and pandemics.

Such events can affect entire sectors or markets. Unsystematic risk relates to the unique risks of a company or industry. These can include financial risks, strategic risks, and operational risks.

Market risk

Market risk, also known as systematic risk, impacts all investments in the market. It is driven by factors such as economic changes, natural disasters, or geopolitical events. During periods of high market volatility and investment risks, stock prices may decline across the board, negatively impacting your portfolio’s value.

For instance, a sudden economic downturn can cause widespread panic selling, leading to significant losses. Evaluating these events through risk-adjusted return analysis can provide deeper insights into their long-term impact on your portfolio.

Credit risk

Credit risk is particularly relevant for fixed-income investments like bonds. If a bond issuer defaults, you may lose some or all of your investment. This risk is higher for bonds with lower credit ratings, making it essential to conduct a thorough investment risk assessment before investing.

A default can have a domino effect, causing other investors to lose confidence and sell off similar assets, further driving down prices. Invest in bonds with high credit ratings and diversify your fixed-income portfolio to mitigate credit risk.

Liquidity risk

Liquidity risk refers to the difficulty of selling an investment quickly without significantly reducing its price. Investments like real estate or certain bonds can be challenging to liquidate rapidly. If you need to access cash quickly, you may have to sell these assets at a lower price, resulting in a loss.

Maintaining a portion of your portfolio in liquid assets, such as stocks or money market funds, can help manage liquidity risk. Additionally, planning your investment horizon and ensuring you have an emergency fund can reduce the need to sell illiquid assets under pressure.

Find out more about Mintos Smart Cash

Interest rate risk

Interest rate risk primarily affects fixed-income securities. When interest rates rise, the value of existing bonds typically falls, as newer bonds may offer higher yields. For example, if you hold a bond paying 3% interest and new bonds are issued at 4%, the market value of your bond will decrease.

This is a crucial consideration in a changing interest rate environment, as even small rate changes can significantly impact your bond portfolio’s performance. Using strategies such as laddering bonds or investing in floating-rate securities can help mitigate interest rate risk.

Inflation risk

Inflation risk erodes the real value of your investment returns. For instance, if your investments earn a 5% return, but inflation is 3%, your real return is only 2%.

This risk is particularly concerning for long-term investors and those planning for retirement, as sustained inflation can significantly reduce purchasing power. Investing in assets that typically outpace inflation, such as stocks, real estate, or inflation-protected securities, can help manage inflation risk.

Currency risk

Currency risk impacts investments in foreign assets. If the currency of your investment depreciates against your home currency, the value of your investment can decrease. For example, if you invest in European stocks and the euro falls against the dollar, your returns will be lower when converted back to dollars.

This risk is significant for investors with substantial international exposure. Hedging strategies, such as currency futures or options, can help manage currency risk and protect your portfolio from adverse currency movements.

Diversify with alternative investments

Political risk

Political risk involves changes in government policies that can affect investment values. For example, new regulations or political instability can adversely impact the market. A sudden change in trade policies can disrupt supply chains and impact corporate profits, leading to stock price declines. Staying informed about the political climate in regions where you invest and diversifying your portfolio globally can help manage political risk.

How to assess and determine your risk tolerance

Investment risk tolerance is the degree of variability in investment returns that an individual is willing to withstand in their portfolio. Determining your risk tolerance in investing is essential to align your strategy with your financial goals and comfort level.

Self-assessment

Begin by reflecting on your financial goals, investment horizon, and emotional response to market fluctuations. How you would react if your investments lost 10%, 20%, or even 50% of their value in a short period? Your willingness to endure these losses without panic-selling is a key indicator of your risk tolerance. Ask yourself:

- What are my long-term financial goals?

- How soon will I need to access my invested funds?

- How do I feel about potential losses in the short term?

Understanding your emotional responses to these scenarios can provide insight into whether you are naturally risk-averse or more comfortable taking risks.

Learn how to set clear financial goals

Risk tolerance questionnaires

Utilize risk tolerance questionnaires, which are designed to help you evaluate your comfort with risk. These questionnaires typically ask about your investment goals, time horizon, financial situation, and reactions to market volatility. Many financial institutions and advisors offer these tools online. They provide a structured way to gauge your risk tolerance through a series of questions, such as:

- What’s your investment horizon?

- How would you react to significant drops in your investment value?

- What’s your primary investment goal (e.g., capital preservation, income generation, wealth accumulation)?

- How knowledgeable are you about different types of investments?

These questionnaires can help you assess your risk tolerance and provide a clearer picture of your investment profile.

More on risk diversification

Factors influencing risk tolerance

Age

- Younger investors: Generally, younger investors can afford to take more risks because they have a longer time horizon to recover from potential losses. They can invest more aggressively in stocks and other high-risk assets that offer higher potential returns over time.

- Older investors: As investors approach retirement, their risk tolerance typically decreases. Preserving capital becomes more important than seeking high returns, so they might prefer more conservative investments, which offer more stability and lower risk.

Financial situation

- Income and savings: Your current income level and the amount of savings you have can influence your risk tolerance. Those with stable sources of income and substantial savings can afford to take more risks, as they have a financial cushion to fall back on during market downturns.

- Debt levels: High levels of debt can reduce your ability to take on risk. It’s often advisable to prioritize debt repayment before making high-risk investments. A lower debt burden allows for greater flexibility in your investment choices and can increase your risk tolerance.

Determine how much to invest

Investment goals

- Short-term goals: If your investment goals are short-term (e.g., buying a house in the next few years), you might prefer low-risk investments to ensure your capital is available when needed. The focus here is on capital preservation rather than high returns.

- Long-term goals: For long-term goals like retirement, you might be more willing to accept short-term volatility for the potential of higher long-term returns. A diversified portfolio with a mix of higher-risk and lower-risk assets can be beneficial for achieving long-term growth.

Risk appetite often depends on an investor’s age and the nature of their investment goals. For example, if an investor’s goal is to preserve capital in the short-term, it would require a low-risk approach and, therefore, a more conservative investment strategy. Whereas for longer-term goals, investors may be willing to accept higher levels of risk.

How to achieve FIRE (Financial Independence, Retire Early)

Personal comfort with risk

- Emotional Responses: Some people are naturally more risk-averse, while others are more comfortable taking risks. Understanding your emotional response to risk is critical. If you are likely to panic during market downturns, a more conservative portfolio may be appropriate. Conversely, if you can stay calm and maintain your investment strategy during volatile periods, you might handle a more aggressive portfolio.

Other tools for assessing investment risk

Worldwide, there are companies providing rating tools to assist investors in learning more about investment opportunities. S&P Global, for example, provides credit ratings based on extensive research for corporate and government bonds, helping to determine a bond’s risk level.

On Mintos, there’s the Mintos Risk Score, which is given to all investments on the platform. Monitored and updated regularly, it aims to inform investors about the current risk level of a lending company.

In addition, licensed investment firms issue prospectuses and Key Information Documents, which are documents that provide all the details of an investment offering.

Although investors shouldn’t solely use these tools to make investment decisions, they can be helpful in your risk assessment of investment opportunities across many asset classes.

Strategies to manage investment risks

By focusing on investment risks for beginners, risk-adjusted return analysis, and risk management in investing, you can better safeguard your financial goals.

- Diversification: Diversification is one of the most effective investment risk strategies for mitigating investment risks for beginners.

This aims to reduce the overall risk of your portfolio by spreading unsystematic risk across multiple investments such as various asset classes, geographies, currencies, and maturities. When you have multiple investment types within a portfolio, the lower-risk investments tend to offset the higher-risk investments – essentially smoothing out the portfolio’s total risk.

By holding a mix of stocks, bonds, real estate, and alternative investments, you can mitigate the impact of poor performance in any one area. Portfolio diversification to reduce risk is a fundamental strategy for managing investment risks.

Learn more about risk diversification - Asset allocation: Adjusting the proportion of different asset types in your portfolio based on your investment risk tolerance and investment goals is crucial. A balanced mix of assets helps manage risks effectively.

How strategic asset allocation can improve returns - Regular portfolio review: Regularly reviewing and rebalancing your portfolio ensures it aligns with your risk tolerance and financial objectives. Market conditions and your personal situation can change, so it’s essential to adjust your portfolio periodically. Investment risks in 2024 may differ from past risks, so keep an eye on trends.

Investment strategies to keep your portfolio on track - Investing in low-risk assets: Allocating a portion of your portfolio to low-risk investments, such as government bonds or high-quality corporate bonds, can provide stability and preserve capital. These assets are less volatile and offer predictable returns, making them suitable for conservative investors or those nearing retirement.

Consider these low-risk investments - Emergency fund: Maintaining an emergency fund to cover unexpected expenses reduces the need to liquidate investments at an inopportune time. This fund should be easily accessible and typically cover three to six months of living expenses. Have an emergency fund so that you won’t have to sell investments during a market downturn to cover immediate needs.

Managing risk in retirement planning: For those near retirement, managing investment risk becomes even more critical. Shifting to more conservative investments and focusing on preserving capital while still achieving growth is essential.

Reduce exposure to high-risk assets and shift toward conservative options such as dividend-paying investments to preserve capital. At the same time, maintain a portion in growth-oriented assets to keep pace with inflation.Plan ahead for retirement

- Risk-adjusted return analysis: Evaluating investments based on their risk-adjusted return helps you understand the returns relative to the risks taken. This approach allows you to compare different investments more effectively and choose those that offer the best returns for the level of risk you’re comfortable with.

Top investment ideas for 2025

Remember, investing isn’t just about maximizing returns but also about safeguarding your investments against potential losses. Stay informed, regularly review your portfolio, and adjust your strategies as needed.

Disclaimer

This is a marketing communication and in no way should be viewed as investment research, advice, or recommendation to invest. The value of your investment can go up as well as down. Past performance of financial instruments does not guarantee future returns. Investing in financial instruments involves risk; before investing, consider your knowledge, experience, financial situation, and investment objectives.