We’re excited to announce that the first Notes are now available on Mintos! Here’s what you need to know about the arrival of the new financial instruments on Mintos.

Key takeaways:

- Investors can now invest in Notes on Mintos

- Currently, there are Notes available for 3 lending companies: CashCredit (Cash Credit Mobile EAD), Eleving LV (AS mogo), and SunFinance LV (SIA Extra Credit)

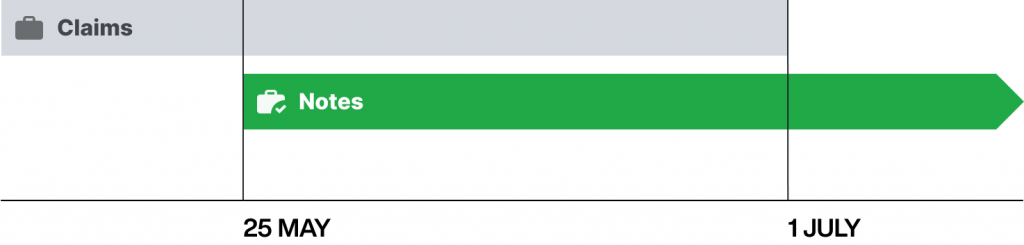

- Until 30 June, you can purchase both claims (via assignment agreements) and Notes. Then from 1 July, you can only invest in Notes

- Active Mintos and custom automated strategies continue to invest as usual, but the investments provided will gradually transition from claims to Notes

- A special Mintos Investor Q&A has been prepared to address popular investor questions regarding Notes

The new way to invest in loans

Today a significant milestone has been reached with the launch of Notes on Mintos. Investors can now take advantage of the many benefits that come with investing in a regulated environment, such as:

- The safeguarding of your assets following MiFID II

- An investor protection scheme of up to €20 000

- A suitable and appropriate product offering

- Increased transparency

Read more about investor protection on Mintos.

Martins Sulte, CEO and Co-Founder of Mintos, says, “we’re excited that our hard work on this innovative setup for investing in loans in a regulated environment has come to its fruition, and we can say with confidence that Mintos has raised the bar as we bring loans as an alternative asset class up to the standard of mainstream financial markets. A clear and well-established regulatory framework such as MiFID II brings additional layers of protection and transparency for investors – something that’s crucial when it comes to an alternative and relatively new asset class.”

If you’d like to learn more about Notes, check out our latest page on how Notes work.

Be among the first to invest in Notes

Currently, you can invest in Notes for 3 lending companies. You can find out about these opportunities with the approved base prospectuses that have been prepared in accordance with Prospectus Regulation and approved by the Financial and Capital Market Commission (FCMC).

- CashCredit (Cash Credit Mobile EAD)

- Eleving LV (AS mogo)

- SunFinance LV (SIA Extra Credit)

Keep an eye out for additional lending companies in the coming weeks.

If you’re ready to add Notes to your Mintos portfolio, head to your account to start investing!

The transition from claims to Notes begins today

Until 30 June, you can purchase both claims (via assignment agreements) and Notes. Then from 1 July, you’ll only be able to invest in Notes.

Active Mintos and custom automated strategies continue to invest as usual, but the investments provided will gradually transition from claims to Notes. To learn more about how Mintos manages investments within Mintos and custom automated strategies, see our information document.

For a more detailed explanation of the transition from claims to Notes, please see our previous blog article.

Or to view all Mintos legal documents, please see our terms and policies.

Mintos Investor Q&A

Recently, we asked you to submit any questions you might have about Notes so we could prepare a special Mintos investor Q&A. This article has now been published, and we hope you find it helpful in getting to know more about Notes. Read investor Q&A

Importantly, we’d like to give a big thank you to everyone who’s been with us on this journey to Notes!