We will be regularly updating this thread, sharing relevant information about the war in Ukraine and sanctions for Russia that have a direct impact on Mintos business and matters of interest for investors.

We kindly ask you for understanding and patience as besides bringing devastating turmoil to the people of Ukraine, the war also resonates through financial markets and influences what we know as normal market conditions.

Follow the updates here, share comments and questions on the Mintos Community, and for the most important information – follow the Mintos Twitter.

Table of Contents

Update 30 June 2023

Kviku and its questionable business practices

As mentioned in a previous update, Kviku informed us post fact that it had unilaterally converted its debt to investors on Mintos into a non-interest bearing bond in RUB with a maturity of 2026. We never agreed to such an approach, as it’s not in the interest of investors. Moreover, we have reasons to believe that the conversion done by Kviku violates local requirements.

However, there’s more to the story. The owners and management of Kviku have taken steps that don’t represent anything close to a normal way of doing business, and directly refute the company’s claims of acting in the best interest of investors on Mintos:

- Just days before Kviku issued the bonds for the purpose of converting the debt, the management and owners of Kviku reassured us that they were applying for special permission from the Central Bank of Russia to make transfers larger than the RUB 10m monthly limit. It goes without saying that they had already been working on the bond issuance for a few months before the actual issue. We have no factual evidence of any actions being taken by Kviku to obtain the special permission from the Central Bank of Russia for money transfers.

- Since then, Kviku has tried to remove the pledges on its portfolio for the funded loans on Mintos by approaching the notary, and after that was not met with success, by filing court cases in Russia in late December 2022.

- After Mintos filed objections to Kviku’s court applications, one of the applications was dismissed by the court and the other one was withdrawn by Kviku before the court ruled on the matter.

- Kviku claimed that no agreements exist and no money was transferred for the part of the portfolio arising from forward flow investments. These claims by Kviku are obviously not true. Forward flow investments represent a smaller part of the portfolio.

Such actions of Kviku to avoid returning investors’ funds came as a big surprise, as prior to the war the cooperation went smoothly. It also seems puzzling from a business perspective that Kviku would be so willing to ruin its reputation, considering its owners and management are also running businesses in other countries, including in Europe.

We can reassure you that we are being represented in these court cases, and we are defending the interests of our investors. Besides these cases, our consultants are also actively working on recovering investors’ money. Please understand that we can only share information on legal cases with a delay, as being too transparent might give away vital information to the opposing party. We’ll share more updates as soon as we can.

Update 16 June 2023

The Revo recovery

- Wait for the entire potential repayment of funds via monthly installments

- Receive less money faster

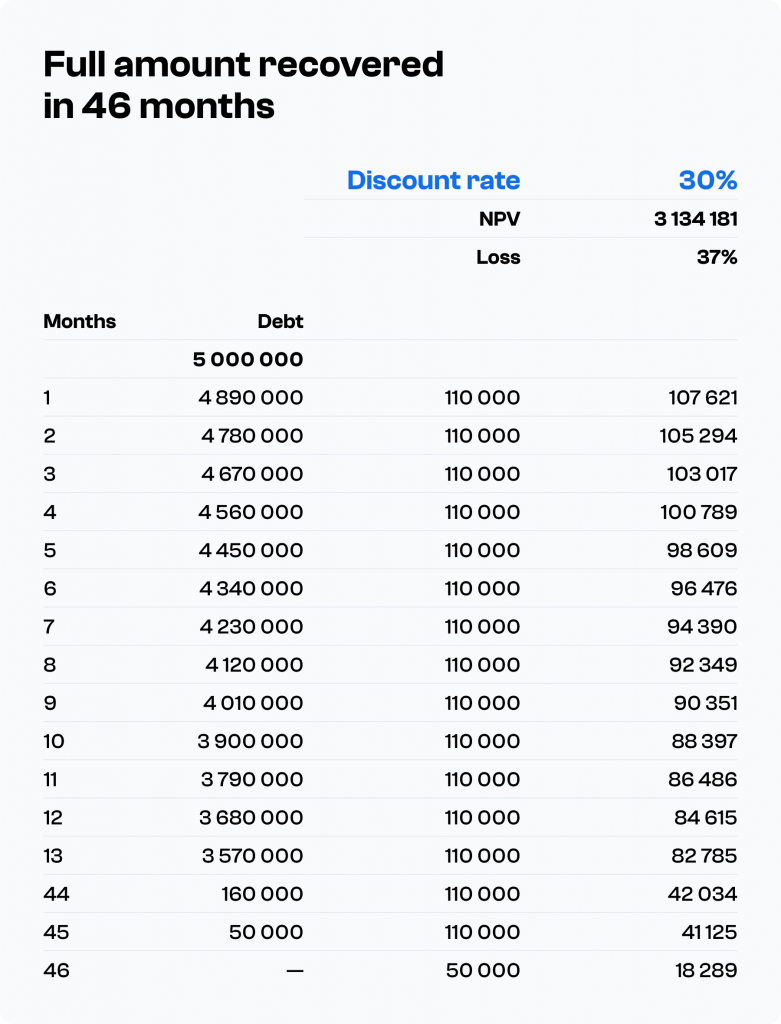

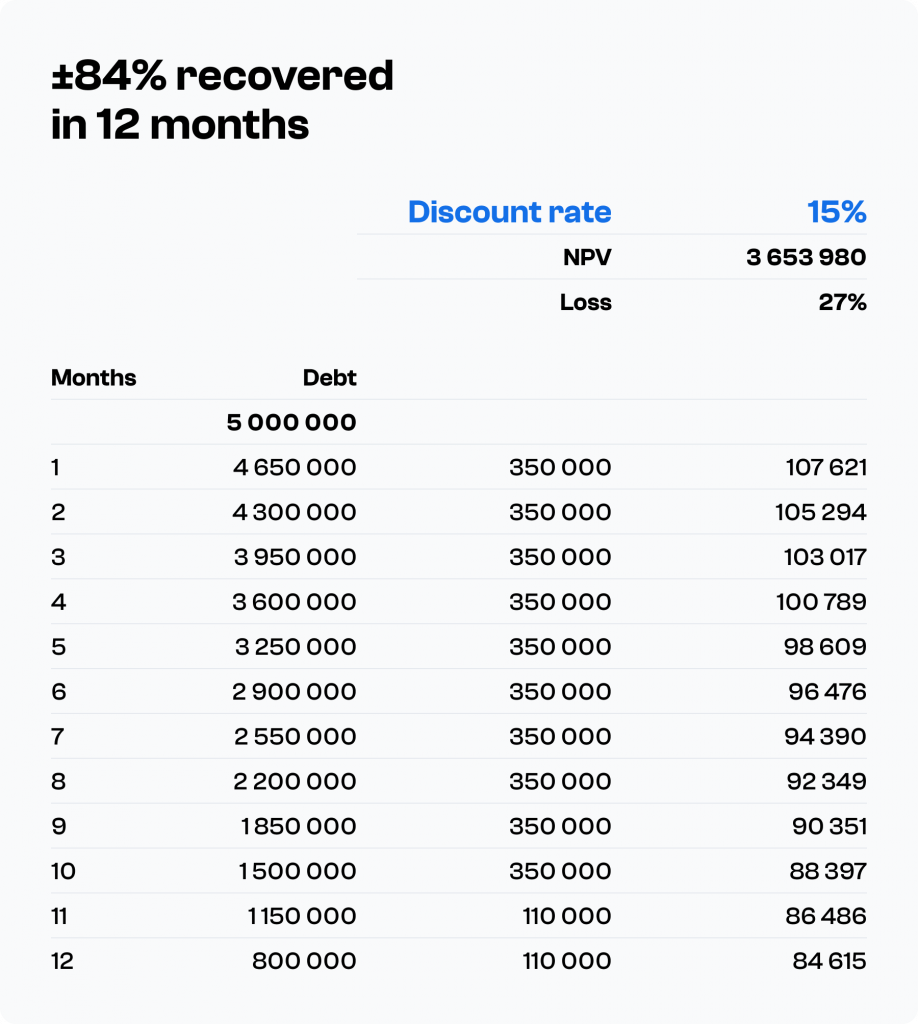

The full recovery example has a 30% discount rate by Revo due to transfer limits imposed by the CBRF. The discount rate is at 30% because we’re taking into consideration the time value of money. The formula for the time value of money takes into account the amount of money, its future value, the amount it can earn, and the time frame. We’re also taking into consideration exchange rate depreciation, the uncertainty of receiving future payments due to political unpredictability, and further escalation of the war. For example, €10 received today is worth more than €10 received in one year. In this example graph with the 30% discount rate, €10 received in one year’s time would only be worth €7.

Please note that the example provided here is a simplified illustration of the rigorous analysis conducted by our risk team. The decision of an acceptable situation where we accept less money than owed, as well as the specific calculations and assessments required, varies on a case-by-case basis.

We chose to accept less than the full amount of the funds owed by Revo. Considering the analysis and consequences stated, our risk team has concluded that receiving less money faster is more beneficial to investors.

Should you have any further questions or require additional information, please do not hesitate to contact us.

Update 19 April 2023

With €10.4 million total recovered, Revo case is closed

After proactive efforts to petition the Central Bank of the Russian Federation (The Central Bank), in September 2022, Revo Russia (OOO Revo Technologies MFC) obtained special permission to accelerate repayment of its obligations to Mintos investors in payments larger than 10 million RUB monthly.

As a condition for granting permission, The Central Bank stipulated a maximum repayment of €10.4 million, or 65% of the lending company’s debt to investors on Mintos. Six months later and in line with the terms of its restructuring agreement, Revo Russia has repaid the agreed total of €10.4 million and we’re closing the case. Any remaining outstanding amounts were declared as bad debt as per Mintos classification, and Revo Russia has exited Mintos.

At the present time, Russian companies are allowed to pay lenders in “unfriendly” jurisdictions not more than RUB 10 million per month. Repayment of higher amounts requires consent from The Central Bank. Such consent typically imposes a loss to creditors, which is a common practice by Russian authorities. When the option of repayment requiring investors on Mintos to accept losses was presented by Revo Russia in September 2022, Mintos evaluated the alternatives. This included Revo Russia only transferring the maximum allowed of RUB 10 million per month allowed under the restrictions introduced by the Russian government.

In our view, going ahead with the accelerated repayment plan agreed to by Revo Russia with The Central Bank and the attached conditions has led to the best outcome for investors, both in terms of the recovered amount and the speed of recovery. This outcome allows investors on Mintos to access and reinvest the repaid funds now to earn a return, instead of waiting several years to collect possibly a higher amount, which may be further impacted by additional regulatory uncertainties.

The funds recovered from Revo Russia have been distributed to investors. The usual amortization sequence was amended and funds were distributed proportionally to all affected investors based on their outstanding investments in Revo Russia portfolios. Mintos fees payable by Revo Russia were also collected proportionally, instead of collecting all fees upfront. The unrecovered amounts (€5.5 million) were classified as bad debt as per Mintos classification. Since Revo Russia joined Mintos back in 2020, through interest and other payments, investors have earned more than €840 000.

We’ll continue working on recovering outstanding obligations to investors on Mintos from the remaining Russian lending companies. We appreciate your patience and understanding in this matter.

Update 3 March 2023

€10 million recovered, agreements reached with most Russian lending companies

It’s been about a year since the start of the Russian invasion of Ukraine which has severely impacted the cooperation with the Russian lending companies. Receiving back investors’ funds has proven to be challenging due to the various sanctions and payment limitations imposed by Russia and the European Union. Nevertheless, considering these external limitations are far from being resolved, we’ve made solid progress:

As of 1 March 2023, €10 million in war-affected loans have been repaid by the Russian lending companies.

Lending company

Initial principal exposure (million €)

Total recovered (principal and interest) (million €)

% recovered (principal and interest)

Revo

15.3

9.1

57

EcoFinance

4

0.3

8.8

Creditter

2.9

0

0

Dozarplati

5.4

0

0

Kviku

40

0

0

Lime Zaim

6.6

0.1

1.7

Mikro Kapital*

1.4

1.1

80

Total

76.5

10.7

13.5

*Mikro Kapital has not been suspended and is making timely payments

Over the past months, we discussed potential options with all Russian lending companies how they could make repayments in a way that was compliant with the limitations we and the Russian lending companies have been facing. Despite the events happening around the war, the reputation of the people involved in the business is in most cases the single most important factor, especially in businesses that require external funding or might be related to operations outside their home country. Until winter 2022 we had seen that all the companies were having the discussion in good faith and with the intent to resolve the situation. As a result, agreements have been reached with all but one Russian lending company, and payments have been made or are being processed by the banks.

However, for one entity, Kviku, the situation has turned out differently. Kviku informed us through email at the end of November 2022 that it had unilaterally converted all EUR debt to RUB, combined it with existing RUB debt arising from investments made outside of Forward Flow setup, and further converted it to an interest free bond in RUB with a principal repayment at the end of 2026. For investments made with Forward Flow (about €5 million exposure), Kviku has neither shared any information nor repaid any funds.

Based on our lawyers’ preliminary analysis, neither the way the funds were converted nor the amounts converted are in line with the existing legislative acts. And we don’t accept this unilateral conversion by Kviku. As previously disclosed, we’ve involved consultants to take certain actions towards recovery of all due amounts. We’ll update you once we have news to share.

Revo: The company transferred another €1.3 million in February, bringing the total recovery from Revo up to €9 million (57% of the initial exposure).

Ecofinance: Ecofinance transferred RUB 8.5 million equivalent in EUR in February.

Lime Zaim: The situation with payment service providers is changing rapidly due to external circumstances. The February payment was initially declined by the service provider, as it stopped accepting RUB. The service provider has now informed that it’s able to receive RUB again, and the lending company will initiate the transfer once more.

Creditter: The lending company’s bank approved the amendments to the agreements. The lending company transferred RUB 10m in EUR to us. The money was distributed to investors on 2 March, and hence isn’t reflected in the table above.

Dozarplati: Now that Dozarplati’s bank has approved the agreement amendments for another lending company using the same bank, we’re making the same type of amendments to the agreements with Dozarpati. Once the amendments have been signed and submitted, we expect that the bank will finally accept the agreements and allow Dozarplati to transfer funds to Mintos.

Mikro Kapital is making timely payments.

Update 16 January 2023

€6.6 million recovered from Russian lending companies so far

As of 16 January, €6.6 million in war-affected loans have been repaid by the Russian lending companies.

Lending company

Initial principal exposure (million €)

Total recovered (million €)

% recovered

Revo

15.3

5.2

40

EcoFinance

4

0.1

3

Creditter

2.9

0

0

Dozarplati

5.4

0

0

Kviku

40

0

0

Lime Zaim

6.6

0.1

1.7

Mikro Kapital*

1.4

1.1

79

Total

76.5

6.6

8.6

*Mikro Kapital has not been suspended and is making timely payments

Over the last months we, together with lending companies, have been working extensively to make repayments of investors’ investments from Russia possible. At this moment, all but one lending company has signed the necessary agreements, which was a prerequisite to make the allowed payments.

The second step in the process is that these lending companies go to their banks to make the payments. This may sound easy, but in reality it’s far from a straightforward process. Banks can challenge the payments, ask for clarification on agreements, or even ask for amendments. The timeframe over which such requests are resolved unfortunately is not solely dependent on us, hence we can’t always directly influence the progress.

Last but not least, once the payment has been sent, it undergoes additional checks by the receiving bank. Considering the constantly changing sanctions environment, these checks can take more time than expected. What’s more, a payment that went through smoothly one time might not necessarily go through the same path next time. We’re providing our banks with all requested information as soon as possible to release the payments faster, but we’re not able to control the banks’ processes and work.

In a nutshell, we’ve been working hard to set up the infrastructure for receiving the payments in a compliant manner and have received additional payments. However, there still might be delays that are outside of our control.

Revo: Revo sent the regular payment of €1.3m in December. The funds will be distributed to investors once the bank has finished its AML and sanctions review and released the funds to us. We had to switch to a new bank, as the previous one, Baltic International Bank, had been placed under administration.

EcoFinance: We initially expect monthly payments of about RUB 8.5m per month, as the company also has to serve other foreign creditors. EcoFinance sent a transfer of RUB 8.5m in December, which was rejected by our bank due to its interpretation of AML and sanctions review. We are getting an additional legal opinion that the payment doesn’t violate sanctions and should be accepted by the bank.

Creditter: Creditter’s bank has asked for amendments to the signed agreements. We’ve updated the amendments, and they are now being reviewed by the bank again.

Dozarplati: Dozarplati’s bank has asked questions about technical details in the agreement. The lending company has replied to these questions and is waiting for a response from the bank when the payment can be proceeded.

Kviku: To protect investors’ interest, we currently can’t disclose more details about the recovery of the outstanding amounts. However, we have started taking certain action already in November to speed up the recovery.

Lime Zaim: We initially expect monthly payments of about RUB 8.5m per month, as the company also has to serve other foreign creditors. Lime Zaim transferred RUB 8.5m in December, which have been distributed to investors.

Mikro Kapital: Payments from Mikro Kapital are going through a complex compliance review by both the lending company and Mintos’ commercial bank. On top of that, the bank is charging significant fees for processing payments from Russia. For those reasons, we’re optimizing the process and adjusting the settlement schedule.

Mikro Kapital is making repayments for investments in EUR and RUB on a regular basis. The company has to convert its RUB liabilities to EUR as our bank doesn’t accept RUB payments. Pending payments have increased since our commercial bank has requested additional information. We’ve submitted the requested information and are waiting for a response from the bank. Since the weekly settlement amounts are relatively small, the settlement period will be changed to a monthly schedule from January to optimize transaction costs.

Update 10 November 2022

SOS Credit

SOS Credit is making small payments of €12k per month. It is currently not possible to transfer larger payments out of Ukraine. The company is operating on a smaller scale compared to pre-war operations.

EcoFinance

We received a payment of €121k from Ecofinance in October that will be distributed to investors soon. In November we expect a sum closer to the RUB 10m monthly limit set by the Central Bank of Russia.

Creditter

The term sheet of the repayment agreement has been agreed, and we’re working on finalizing the rest of the agreement. Once the agreement has been signed, the lending company will make monthly repayments within the RUB 10m monthly limit set by the Central Bank of Russia.

Dozarplati

The repayment agreement has been signed. The company will start making payments within the RUB 10m monthly limit set by the Central Bank of Russia from November.

Kviku

We’re in the process of negotiating a repayment agreement. As the company has a substantial exposure, it is working on an agreement with the Central Bank of Russia to make larger payments than RUB 10m per month.

Lime Zaim

We’re in the process of negotiating a repayment agreement. Once the agreement has been signed, the lending company will make monthly repayments within the RUB 10m monthly limit set by the Central Bank of Russia.

Update 14 October 2022

€414k received from Mikro Kapital

Mikro Kapital RUS has made a payment in the amount of €414k to settle its RUB pending payments. The money has been distributed to investors in EUR. The payment was converted to EUR by Mikro Kapital’s commercial bank at a rate of RUB 1 = €0.015.

Update 7 October 2022

€1.3m repayment received from Revo Technologies

We received a repayment of €1.3m from Revo. The money will be distributed to investors shortly.

Update 30 September 2022

Progress on monthly transfers of RUB 10m

We’re making progress with setting up regular transfers from the Russian lending companies within the limit of RUB 10m per month imposed by Russia. There have been some delays due to regulatory uncertainty for the lending companies which are still being clarified between the companies and their regulators. Additionally, we need to agree on the exact terms for the transfers with the lending companies, such as which exchange rate would be applied. We expect to receive the first payments in the coming weeks, provided the external factors don’t change.

Progress with the alternative routes for payments from Russia

We have reviewed all reasonable options for alternative payment routes, and they all led to the same key point: As the Russian lending companies are licensed businesses, all alternative payment routes that would allow transfers greater than RUB 10m per month include aspects that require consultation and approval with the competent regulator, the Central Bank of Russia. Mintos and the Russian lending companies are working with local consultants to obtain the Central Bank’s approval.

Update 19 September 2022

€2.6m repayment received from Revo Technologies

OOO Revo Technologies MFC obtained special permission from the Central Bank of the Russian Federation to repay its obligations to Mintos investors in payments larger than 10 million RUB monthly. In light of this permission, Revo has already transferred the first tranche of its repayment in the amount of €2.6m, and Mintos has received these funds on its accounts.

The repayment of Revo’s obligations is a direct result of months-long efforts of the Mintos and Revo teams to identify repayment solutions, allowing Revo to honor its obligations to investors on Mintos despite the restrictions imposed by the Russian and EU regulators.

It is Revo management’s intention to continue to make monthly repayment of its obligations if no new regulatory or financial sector obstacles arise. In order to ensure the most fair treatment of Mintos investors in the given situation, the usual amortization sequence will be amended and repaid funds will be distributed proportionally to all affected investors based on their outstanding investments in Revo portfolios. Fees due to Mintos from Revo will also be collected proportionally, instead of collecting all fees upfront.

The pending repayment will be distributed to affected investors in the coming days. Please note that the amount reported as in recovery will not immediately reflect this latest repayment, as some additional IT development is required on our side. Once this development is completed, the reported amounts will be updated accordingly.

So far, Revo has been the only Mintos partner able to obtain a special permission from the Central Bank of the Russian Federation to repay a portion of its outstanding obligations to investors on Mintos. Mintos will continue to provide updates as we receive further information from other lending companies in Russia.

Update 5 August 2022

First Russian lending company payment distributed to investors

Following yesterday’s update on the new FX account, we’re pleased to have received 10 million RUB from Revo, which was converted to around €143k. This payment is already being distributed to affected investors today. The agreement with the service provider of the RUB account is such that the money becomes accessible to us once it is converted to EUR at the offered rate. The rate will differ from the stated exchange rate of the Central Bank of Russia, which according to our knowledge, still does not reflect the actual market rate at which money can be exchanged. This is because it doesn’t take into account bid-ask spreads, any commissions included by service providers, and other factors given the disrupted market in RUB.

We will continue to provide updates as we receive further payments from other lending companies in Russia within the allowed 10 million RUB payment limit. Although this is only a small amount to start with, we are glad to see that some movement is happening. In the meantime, we are continuing to work on alternative payment routes to make more sizeable payments.

Update 4 August 2022

Account has been opened for payments in RUB

We have opened an account where RUB payments can be received and subsequently exchanged for EUR. This means investors will receive back funds in EUR. However, before these payments can be received, some additional paperwork needs to be completed with the lending companies – we are now clarifying what needs to be done and will provide you an update on expected payment timelines. Please note there is a limit of 10 million RUB that can be paid within a calendar month by each lending company for all international debts. In the meantime, the work on alternative payment routes that would allow larger payments is progressing.

Agreement with SOS Credit to cover monthly payments

We’ve agreed with SOS Credit that they will cover €11.3k monthly, which will be used to cover the accrued pending payments. SOS credit has restarted issuing loans in Ukraine and is paying a similar amount to other creditors as well.

Update 15 July 2022

SOS Credit Ukraine continues operations in the country

To a limited extent, SOS Credit continues the lending activity in Ukraine, outside of occupied territories. While the company’s customer base is limited, SOS Credit continues to work with its existing clients. The loan collection processes have been adjusted to the current situation in the country and mainly focus on activities such as informing clients about the amount of existing debt and data assessment about potential possibilities of upcoming debt repayments.

In July, the company started to slowly roll out lending to new customers, with products and scoring methods adjusted to the new conditions, and in order to assess information about the market and clients in the current environment.

Going forward, as long as conditions allow it, SOS Credit will be making occasional repayments to Mintos investors in the amount of approximately €12 000. Due to the uncertainty of the business environment in Ukraine and continuous threats to this market, this is only an estimate and we can’t announce a precise payment schedule.

Update 8 July 2022

Performance of the Russian lending companies

In the financial statements and portfolio statistics that were sent for recent monitoring we did not see significant changes or deterioration in portfolio quality or financial stability of the Russian lending companies.

On the one hand, some lending companies took advantage of the high demand on the market for short- and mid-term loans from non-bank lenders that was caused among other reasons by the increase in the Key Rate set by the Central Bank of Russia.

On the other hand, other lending companies in Russia have decreased issuance of new loans in response to uncertainty in economic conditions in the country and potential deterioration in repayment quality and increase of debt recovery costs.

Progress with the third-party provider for RUB payments

We continued work on setting up a potential third-party provider who would offer a solution for both receiving payments in rubles and exchanging rubles for euros. You can read more about this in the update from 31 May 2022. We have submitted the required documents, and they are now being reviewed by the provider. This setup would enable transfers in rubles within the RUB 10 million monthly limit imposed by Russia. We are working in parallel on alternative routes with a different setup.

Progress with the alternative routes for payments from Russia

There are separate workstreams when it comes to establishing alternative routes for transferring payments from Russia. Work on the setup continues by both Mintos and the lending companies.

Payments due from investments in loans from Russia and Ukraine reclassified

Payments due from investments in the Russian and Ukrainian loans have been removed from the pending payments and reclassified as funds in recovery, as announced in the update from 10 June. The repayment status is reported in a separate section of the monthly recovery updates. This reclassification will not change our efforts to find ways to get money out of Russia as soon as possible.

Update 10 June 2022

Sixth package of restrictive measures against Russia and the new obstacle for the ruble transactions

The EU has adopted the sixth package of restrictive measures against Russia. The framework of sanctions related to financial and business services includes a new decision to remove three more Russian banks from SWIFT, including the largest, Sberbank. One bank from Belarus has been added to this list, too.

We’re sharing this because as the sixth package of sanctions was announced, the remaining Mintos servicer bank that occasionally accepted transfers in rubles paused the already limited servicing of this currency. The bank had been waiting for information about the newly sanctioned banks, and in light of the new measures decided to completely stop ruble transactions until further notice.

This is why we’re now working to find ways to enable transfers in rubles, limited to 10 million a month by the Russian government.

In the update from 31 May 2022, we shared information that we’re exploring the setup with a third-party provider who offers a solution for both receiving the payments in rubles and exchanging the rubles for euros. We’ve made progress in this case of finding a substitute for the bank that has blocked the transactions. We are currently in the onboarding stage with one service provider, in the phase of the KYC assessment. To clarify, this setup would enable transfers in rubles within the RUB 10 million monthly limit imposed by Russia. We are working in parallel on alternative routes with a different setup.

Progress with the alternative routes for payments from Russia

When it comes to alternative routes for payments from Russia, we’re happy to share that there are some new developments in the process of setting up new payment channels. The documentation needed for the business contracts is currently being prepared, such as confirmation of the outstanding amounts, cost estimates for the external services, and the Mintos repayment schedule proposals. We will share more about this in the upcoming weeks.

Reclassifying payments due from investments in loans from Russia and Ukraine

From 13 June 2022, payments due from investments in the Russian and Ukrainian loans will be removed from the pending payments and reclassified as funds in recovery. We initially classified these payments as pending payments primarily because we couldn’t anticipate the duration of the payment delays that started due to the war in Ukraine, sanctions against Russia, and Russia’s retaliation measures. As the war goes on, we understand that it will take longer to receive the due payments from investments in loans from Russia and Ukraine. By their nature, these payments now don’t correspond to what pending payments are by definition. This change in the classification will not change our efforts to find ways to get money out of Russia as soon as possible.

Starting from July, the status of repayments due from investments in loans from Russia and Ukraine will be reported in a separate section of the monthly recovery updates.

Update 31 May 2022

Takeaways

- Amounts that can be transferred from Russia to “unfriendly countries” are still limited to RUB 10 million a month

- Even when RUB transfers are accepted, exchanging RUB amounts to EUR is possible only occasionally

- Lending companies who are clients of sanctioned banks still can’t make any transfers to the EU

- Mintos is in the process of setting up a new payments channel with a third-party service provider (the limit of RUB 10 million still applies)

- 80% of surveyed investors said they would be willing to bear additional costs that come with the setup of alternative transfer routes

- We’re in the process of assessing all needed steps for setting up alternative routes, while remaining compliant with requirements coming from sanctions and regulation

- We’re sharing statements from Russian lending companies – Creditter, DoZarplati, Lime Zaim, Eco Finance, and Kviku

It’s been over three months since Russia launched its war on Ukraine. Investors on Mintos as well as Mintos itself are directly affected by the sanctions on Russia and the Russian retaliation measures.

Since then, there has been barely any change when it comes to transferring payments that are due to investors and Mintos. Laws and requirements within the Russian borders are set up in a way that only a limited number of banks can transfer limited amounts from Russia on a monthly basis – and even then, only in rubles (up to RUB 10 million). Outside of Russia, banks are reluctant to receive any payments in rubles. And even when they accept rubles, an exchange to euros is only possible when another client of the bank wants to purchase rubles.

That’s why we’re currently preparing a setup with a third-party service provider who offers a solution for both receiving the payments in rubles, and exchanging the rubles to euros. This service should enable easier transactions of still limited amounts in RUB from Russia, and it’s not related to the alternative routes setup we mentioned in the previous communication. We will share more information about the success of this setup in the following days.

As we considered various, but due to sanctions very limited alternatives, we recently reached out to investors to understand their opinions on what cost they would be willing to bear in case we develop alternative routes for the repayments from Russia. And if there is interest in cost bearing at all. To remind, the costs would only include the direct costs of setting up new transaction routes, such as fees for third-party service providers, opening new bank accounts, currency exchange costs, etc. Mintos would not benefit from these costs in any way.

We found that 80% of investors are interested in getting their payments sooner, with various levels of costs being considered acceptable, ranging from 5% to 20%. We started setting up processes for the alternative payment routes for a few lending companies.

We remind you that setting up an alternative route might take time.

First, working within the framework of a regulated investment firm while being compliant with all sanction-based restrictions gives us a set of rules we need to follow. Second, lending companies supervised by the Russian Central Bank also need to adhere to certain rules. At any time, new sanctions or new decrees made by the Russian government can deteriorate the process.

It’s important to note that lending companies from Russia currently have sufficient assets to settle their liabilities to investors.

To track the state of payments from Russia, you can always visit the pending payments report page, updated every Friday.

Statements from the Russian lending companies

Last week, we reached out to the lending companies from Russia with some questions, and below we’re sharing their responses.

We asked them the following questions:

- Three months in, what is the impact of sanctions and retaliation measures of Russia on the lending company’s business?

- Do you notice any significant changes in borrowers’ behavior?

- What’s the health of your current loan book portfolio?

- Would you like to share a general message for investors on Mintos who have invested in loans issued by your lending company?

We talked to: Creditter

We’re sharing the responses to our questions shared with Creditter in full.

Responses and information provided don’t represent the opinions of Mintos. Mintos has done no valuation of the data provided by Creditter.

“Three months after the imposition of sanctions and Russia’s retaliatory measures, the microfinance market [in Russia] began to adjust to the new realities. Analysts believe that the identified trend indicates a decrease in the risk of mass defaults. It is likely that in the coming months, the application approval rate in the segment will again rise to above 30%.

According to analytical data, at the beginning of spring, the payment discipline of the borrower slightly decreased. Today, delays of 90 days or more remain at the same level, as the population has formed a monetary safety cushion due to the fall in incomes of the country’s inhabitants against the backdrop of rising inflation. But already at the beginning of the fourth quarter, we expect the restoration of payment discipline due to the improvement in the situation in the country and the world as a whole.

The company today notes a significant increase in borrowers’ requests for a grace period, as well as for the restructuring of existing debt due to the fact that the Russian legislator proposed measures to support consumers of financial services, in particular, providing for the possibility of obtaining a deferred payment (grace period) for a period of up to six months – in case of a decrease in income by 30% or more. In addition, the Bank of Russia recommended that market participants implement their own support programs.

Our company has established itself in the financial market as a reliable partner, which acts from the position of the need to fulfill its obligations, as well as to maintain international business relations. As a responsible market participant, we are also bound by the requirements of the current legislation, by which we are temporarily limited in our capabilities. But we are making every effort to find solutions and look forward to resuming full cooperation in the future.”

Creditter management

We talked to: DoZarplati

We’re sharing a summary of short-form responses to our questions shared with DoZarplati. Responses and information provided don’t represent the opinions of Mintos. Mintos has done no valuation of the data provided by DoZarplati.

When it comes to the impacts of sanctions on Russia on DoZarplati’s business, the management doesn’t see any direct impacts.

They also don’t see significant impacts on the borrower’s behavior. “The borrowers began to pay a little longer (meaning, the share of early repayments decreased). There are also more quality borrowers (due to a sharp decline in bank lending).”

Talking about the loan book portfolio at the moment, DoZarplati shares that “globally, nothing has changed. [The loan book portfolio] is stable.”

Pavel Sologub, CEO of DoZarplati

We talked to: LimeZaim

We’re sharing the responses to our questions shared with LimeZaim in full. Responses and information provided don’t represent the opinions of Mintos. Mintos has done no valuation of the data provided by LimeZaim.

“Dear Mintos Investors,

The impact of sanctions and retaliation measures were highly impacting regulatory rates in February and March because of FX [RUB currency exchange]. Mintos investment suspense was also a substantial challenge for the Company. Still, Lime Zaim has adapted its operating business model in order to keep up with increasing demand with its own funds. Another issue that the Company is dealing with is the expensive hedging service, due to the stronger rouble in April and May because of legislative limitations on foreign currency repayments.

“Referring to the changes in clients’ behavior, recently there has been a dramatic increase in MFO (microfinance organization) demand from new borrowers. Still, Lime Zaim is keeping a conservative approach focusing on returning clients to keep high recovery rates. Currently, we do not observe significant deviations in clients’ payment discipline. The volume of incoming payments corresponds to the seasonality and restrained portfolio growth.

Generally, customer behavior confirms our hypothesis that the scenario of the pandemic year of 2020 is repeating. We continue to carefully analyze the situation and respond to any changes in clients behavior in order to make comfortable conditions for customers to repay their debts and continue cooperation with Lime Zaim. Automated scoring of customers’ behavior at different stages of interaction with them allows us to increase the number of returning clients, and maintain the quality of the loan portfolio. Furthermore, the country continues to put forth an edict on the resumption of credit holidays for citizens with reduced incomes.

Therefore, despite the fact that there have been prerequisites for a decrease in payment discipline indicators, we do not point out material decreases at the moment. There was a slight increase in 60 DPD [days past due] portfolio share in March, which turned to its normal rate in April.

“Lime Zaim has been effectively cooperating with Mintos since 2018, and we are keen to maintain our long-term partnership. The company continues negotiations with representatives of the platform, considering various possible scenarios of fulfilling obligations to investors.”

Olesya Kiseleva, Managing Director of Lime Zaim

We talked to: Eco Finance

We’re sharing the responses to our questions shared with Eco Finance in full. Responses and information provided don’t represent the opinions of Mintos. Mintos has done no valuation of the data provided by Eco Finance.

“Three months were tough for us, due to the not very stable situation in the Russian market and the absolute unpredictable behavior of customers and the [Russian] government. We face a lot of negative signs in risk and forecast an upcoming crisis in the consumer sector. We expect that a major hit will appear at the end of the summer period or in mid-autumn. However, while it is a local market where we operate and there is no major risk in the regulation of the online sector, like no card payments or account ban, we still look positive in market development even if risk indicators are higher than expected and what we forecasted at the beginning of the year. We already managed to adopt a risk and marketing strategy for current market indicators and risk performance. At the same time, our company already developed a list of products and programs for clients’ delinquency support, which perfectly fit the current market stage. Time is tough, but we are looking for a bright future based on a very experienced team and hard work that we do 24/7 to support business and investors in such unstable times.

It is observed that the client performance worsened after the 24 February 2022, in payments and contractibility. The overall deterioration of net loss was around 3% in February/March vintages, in comparison to immediately prior to 24 February. The main impact was felt in new client performance, especially in February vintage payments. The effect was smaller on installment loans, but still, the net loss increased by 1% in the February vintage. However, starting from mid-April, portfolio and vintage performance started to improve, although as of now, the net loss is still 1% higher in April vintage than prior to 24 February.

Starting from 24 February, EcoFinance has introduced restrictions on [loan] approval and lower segments of score groups were cut. Collection resources and strategy were reinforced as such, to put more emphasis on affected segments. The active book started to grow in the middle of May, but growth is now more on the repeated long-term installment loans than on short-term PDL. April payments in 15 DPD [days past due] are still 1% lower than prior to 24 February, but they have increased by 2% to 91% from its low point. Also, delinquency in 1-60 DPD started to decrease in the total portfolio.

Further development of the situation is hard to predict given the legal and economic risks, but until now, Ecofinance has reacted quickly to changes and has shown good risk management and prevention skills. Ecofinance is doing everything possible to maintain the risk on an acceptable level, and together with Mintos, we’re exploring for possibilities to repay funds to investors.”

Dmitry Tsymber, CEO Eco Finance

Kviku

As per suggestion of the Kviku management, we’re sharing the Kviku report that the company provided for the shareholders of the Iuvo Group. Responses and information provided don’t represent the opinions of Mintos. Mintos has done no valuation of the data provided by Kviku in the shared report.

“The complicated relationship between Russia and Ukraine in Q1 of 2022 directly affected not only the two countries but the entire world as well. As a company that operates in Russia, Kviku took timely actions to keep the trends for the positive development of the company.

- The company keeps the trends for growth in profit compared to Q1 2021, despite the complicated geopolitical circumstances;

- Stable business operations and conservative approach in portfolio growth;

- Future plans for expansion in the second half of 2022.”

In the statement provided by N. A. Lomakin, Kviku founder and CEO, the company shared the following information about its business results as of Q1 2022:

– Net loan portfolio decreased slightly during Q1 from €69 million as of 31 December 2021 to €68 million as of 31 March 2022 (- 1.5%) in an effort to preserve liquidity

– Net profit remained solid at over €1 million in Q1 proving stable market conditions in Russia so far

– Fixed costs remained low despite 3x growth in portfolio size (Q1 2021 vs Q1 2022) and amounted to just 10% of revenue

Operations

“Kviku operations in Russia remain stable, with borrowers making payments to local bank accounts as usual. The number of applications for credit holidays remains low (less than 1% of total issuance volume), with NPL rates currently unchanged and monitored by our Risk team on a weekly basis. We have gradually restarted issuance for new clients in BNPL segment and expect the loan portfolio to continue growing in the next quarters of 2022.”

Update 29 April 2022

Details about the state of transactions from Russia

We are sharing the most recent information about details related to the process of transactions of money from Russia, in the case of Mintos and the Russian lending companies.

On the Mintos Community, some investors inquired about the information shared in a German media outlet saying that the currency exchange and transactions from Russia are now allowed. We have to say that this information is only partially correct and does not imply changes in the status of transactions from Russia to Mintos investors.

We communicate with the lending companies and banks on a daily basis, and we follow the news regarding this topic with heightened focus, as we are eager to stay on top of the developments which are very important for our daily business.

The situation with the state of transactions has not changed since our previous updates. Here’s how it looks at the moment:

- Lending companies in Russia are still prohibited from sending EUR payments to companies in countries listed as “unfriendly”, which includes the whole European Union.

- Transactions of RUB payments to RUB accounts of the Mintos servicer banks are still limited to RUB 10 million per month (later in the text, we are sharing more about the structure of these transactions in practice).

- The above limitations have been lifted for private individuals or companies of national interest in Russia, but this does not translate to the status of lending companies that work with Mintos.

Access to the funds in rubles

Lending companies that are clients of sanctioned banks can’t make any transfers to the EU whatsoever, since the payment communication between the sanctioned banks and the European market has been cut off as part of the measures against Russia due to the war in Ukraine.

Lending companies who are clients of unsanctioned banks can send payments of up to RUB 10 million* per month to accounts of foreign companies, such as Mintos. As we shared in previous posts, many banks in the EU don’t accept such payments at all. When it comes to the EU banks that do accept them, including some of the Mintos servicer banks, the RUB funds are transferred to their Russian correspondent banks who are servicing and holding the RUB currency for them. This is how the transactions work also under normal market conditions. But currently, due to the sanctions and the banks’ risk management procedures, these funds are not available to clients.

For these funds to eventually become available to Mintos and investors, the EU bank, in this case the Mintos servicer bank, needs to exchange these funds from rubles to euros. This can be done only when another client of the bank wants to buy rubles for euros.

In order to unlock some of the RUB payments accumulated over the past two months, we have agreed with the servicer bank to proceed with the RUB to EUR exchange for Mintos whenever there’s an opportunity for that, or whenever a buyer of RUB requests such service from the Mintos servicer bank. This results in occasional transactions of EUR repayments to Mintos, which are then credited to investors’ accounts. The transaction amounts vary in size and frequency, as they depend on the demand within the banks’ client network.

While the value of the ruble has recovered, in general, exchanges are still limited. Also, the currency exchange price in the commercial market differs from the rate published by the Central Bank of Russia. It is 5-10% lower than the value listed by the Central Bank.

These occasional exchanges of investors’ funds in RUB to EUR will be an ongoing process until there are significant changes in the regulation of RUB/EUR transactions from Russia to companies located in the EU. In parallel, Mintos and the lending companies are working on potential alternative solutions (more about this below).

In case an investor is interested in an option to receive their payments in RUB, this would be theoretically possible, but not very straightforward or quick. The investor would need to reach out to Mintos with this request, and have an active account with a Russian bank. We would then further explore options to proceed with this option.

We are working on alternatives to disrupted transaction channels

We are closely following investors’ ideas and questions shared across the Mintos communication channels. We heard suggestions about solutions for repayments some investors are proposing, for example banknotes, or cryptocurrencies. This option is not viable for the lending companies regulated by the Russian Central Bank. The companies would risk their license, and that would negatively affect the recovery of investors’ funds from Russia. Also, these proposed alternatives are not allowed or available to Mintos under the regulator’s rules.

To enable somewhat easier payment flows from the Russian lending companies to investors on Mintos, we are actively working on exploring the alternative channels. For example, we are looking into the development of an intermediary network to access investors’ funds sooner.

Please note that any potential solution needs to be compliant with the requirements of EU sanctions. At the same time, it also needs to ensure that on the other side of the relation, the lending companies are compliant with the Russian retaliation measures when working with companies based in “unfriendly countries”.

Assist us by participating in the questionnaire

An alternative route via a network of intermediaries would impose new costs for transactions, such as setting up new business vehicles, servicer fees for third parties, currency exchange, etc. That is why we want to get your feedback about the costs that might be incurred in this process.

Soon, we will be reaching out to investors with significant exposure to loans from Russia to inquire about acceptable costs for alternative transaction solutions.

We will share more about the status of this project in the upcoming weeks.

*Approximate value in EUR for RUB 10 million was between € 80 000 and € 130 000 over the past month, depending on the available currency exchange rates.

Update 19 April 2022

Last week, Mintos’ servicer bank allowed the KZT exchange again for an undefined period of time.

After the recent bank holidays, the currency exchange KZT – EUR – KZT is again enabled on Mintos this Tuesday, and with the current market conditions, it will remain open until midday Friday. It will be closed again during the weekend, to avoid the effects of possible changes and fluctuations.

Please, note that the exchange activity for the KZT on Mintos is enabled due to the current availability of this service by the servicer bank with which the available funds in KZT are held. Hence, it can be disabled at any moment, at the sole discretion of the bank.

The rate applied will be based on xe.com (updated hourly).

Update 13 April 2022

KZT exchange is currently enabled

This Wednesday, we temporarily enabled currency exchange for KZT to EUR and EUR to KZT on Mintos. The currently enabled currency exchange will be open until midday on Thursday 14 April. After that, it will be closed again in order to avoid any major changes that might emerge during the upcoming bank holidays.

As we shared before, investors’ funds available in KZT are held with the servicer bank. At the moment, the correspondent bank of the Mintos servicer bank has made some adjustments to new market conditions. This is why for now, the KZT exchange will be available for undefined periods of time and under controlled conditions. If market conditions change significantly, or the correspondent bank’s decision impacts the decision of the Mintos servicer bank for KZT, the currency exchange will have to be disabled.

At the moment, we’re able to support the exchange rate from the XE (updated hourly).

We will inform you about the new status of the currency exchange for KZT on Mintos after the bank holidays.

Update 8 April 2022

KZT currency exchange update

Banks are still not allowing currency exchange for the KZT, and there continues to be difficulties with bank transfers in KZT. Unfortunately, Mintos is unable to influence this matter.

Over the last month, there have also been complications in making and receiving payments in KZT for lending companies from Kazakhstan. This was a result of a regulatory issue that is now almost resolved. Mintos is hoping that in the upcoming week, the incoming and outgoing flow of KZT payments will resume once again.

In parallel to the above, Mintos is already in communication with local banks in Kazakhstan to discuss the possibility of Mintos opening a local bank account. This is a work in progress, and if finalized, should make exchanging and dealing with KZT much simpler going forward.

In case you missed it

We’ve published two key articles further informing investors on Mintos about the economic impacts of the war in Ukraine.

First, we published a general overview of how sanctions for Russia and the country’s response have impacted international financial markets. The effects are extending to anyone with exposure in Russia, from the largest banks and investment funds to companies like Mintos. Read more

Next, we shared insight into how the emerging influences of the war have affected the usual processes at Mintos when it comes to the Russia-related parts of our business. We also look into three basic scenarios for possible repayment prospects for Russia-issued loans. Read more

Update 21 March 2022

Proof of payment received for some weekly settlements in RUB

We received proof of payment for a smaller part of settlements that are due by Dozarplati and Creditter. The lending companies were able to make a transaction in RUB via their banks which are not sanctioned or related to sanctioned banks. RUB transactions in limited amounts are a result of regulations set by the Russian government, as an internal response to international sanctions. The funds will be released to investors’ accounts as soon as they reach Mintos. In the meantime, a few other lending companies from Russia are working to set up accounts in new banks, a usually lengthy process that is further complicated by the current political environment in Russia.

Statement from Ecofinance

EcoFinance, a lending company from Russia which had short-term and personal loans for investments on Mintos, is reporting deterioration in its daily operations as the first sign of the impact of sanctions for Russia and the country’s response to the sanctions.

Leonid Dulenkov, director of Ecofinance, said that the “unprecedented stress test from all fronts” comes from the exchange rate deterioration and legislative restrictions, which are further impacting portfolio quality and the company’s liquidity.

Ecofinance shared that their action to preserve their operations was prompt right after 24 February 2022. “We quickly decreased our daily issuing volumes up to 40% and lowered risk by limiting the onboarding of new customers by more than 2/3. We boosted our collection efforts, introduced more settlement and restructuring options. We also actively approached any withdrawal request from the local Russian investors in roubles. As a result, the current portfolio is down by 7%, early delinquency is up by 21%, and funding costs increased approximately by half,” said Leonid Dulenkov.

Ecofinance further shares that while on the operational and team level all processes are functioning as usual, the sanctions and Russia’s internal response to them are having a wide impact. “We face severe restrictions to the free flow of capital, impact on our ability to do any payments in foreign currency, and on the ability to pay creditors from the Western markets. We are concerned the portfolio may further deteriorate due to massive closures of foreign companies and stalling of the local business due to disruption in supply chains. Hence, there is an expected significant drop in GDP and shock in employment,” said Dulenkov. As a result, the company’s solvency might be affected in the upcoming months, and he further addressed the impact for the Mintos investors. “Due to the nature and origin of our obligations towards Mintos and its investors, if the current exchange rate would be applied, we would be below the minimum capital requirement, and we face risk on the seizure of assets at any moment.”

“In Ecofinance, we are doing our best and will do what it takes and beyond to keep the company afloat. We are looking, together with Mintos, for the possible options to meet the minimum capital requirement to make any settlements in the upcoming period,” adds Dulenkov.

In the meantime, at Mintos we’re well aware of the uncertainty the Russian businesses face in the current economic environment, as we stay in contact with all lending companies from Russia on a daily basis. In our regular communication, we observe a strong willingness of these companies to keep their businesses going and meet their obligations towards investors, while their ability to do so is influenced by severe external factors.

We will keep you informed about any new developments related to this lending company.

KZT currency exchange still not enabled by correspondent banks

Mintos’ servicer banks can’t make currency exchange to/from KZT, as this is not currently allowed by the servicers’ correspondent banks in Kazakhstan. We don’t have more information except that this is the decision made by local Kazakhstani banks that work with the Mintos servicer banks. Please remember that Mintos has no ability to influence the decision of foreign currency holding banks that work as third party service providers of Mintos’ servicer banks.

Update 16 March 2022

We are sharing some information about the war in Ukraine and sanctions for Russia that are influencing normal market dynamics in worldwide markets and on Mintos.

While there were no significant events directly related to operations of Mintos, daily new measures of countries and organizations introduced for Russia and known effects of the sanctions are giving more certainty on their direct impacts on the economy of both countries, and on global markets.

Here’s the latest short overview:

- Eleving Belarus has transferred all of its dues to Mintos. This is still possible as Belarus banks are not banned from the transfer of EUR to accounts abroad. Besides this, we underline that the Belarus entity is part of Eleving Group, hence group guarantee would be exercised in case of any further disruptions in payments.

- Over the last few days, investors were showing interest in how sanctions for Russia will resonate in Kazakhstan’s market and how they impact KZT, which in some cases might be related to RUB. We saw this implication recently with one of the investors’ funds holding servicer banks who held KZT with the correspondent bank in Russia (read more in the updates below). On 15 March, IDF Eurasia held a webinar for investors and investors on Mintos. Boris Batine, co-founder and CEO of IDF Eurasia, addressed the current state of the company, talked about the growing equity position, and presented data about portfolio performance and income in 2021, signified by growth compared to 2020. The recording of the webinar can be found here.

- The European Council has introduced the fourth package of measures against Russia, targeting companies in the energetic sector, iron and steel trade, companies in aviation and military industries, and powerful individuals close to the Russian leadership.

- As international companies suspend or pause their business activities in Russia, many people are losing their jobs. Around 100 000 Russians have become jobless due to McDonald’s, Ikea, and PepsiCo alone, stopping their operations. With more than 300 companies on the same path, millions of Russians will lose their jobs by the end of the year, unless there are positive developments in the war resolution.

- We understand that this might potentially be reflected in the Russian borrowers’ repayment ability on a general level, and the country has introduced credit holidays for those directly impacted by sanctions. At the moment, lending companies still report that the repayments of their borrowers are unobstructed, but transactions of repaid amounts from Russian to European banks are still not possible due to reasons we explained before (find more in the updates below.)

- Both Mintos and lending companies from Russia are working to find ways for alternative and sanctions-compliant channels for the transfer of borrowers’ repayments. As soon as it will be possible to assess the value of RUB and related costs that occurred during the period of disruption in repayment schedules, we will be able to share more precise information with investors about each lending company’s case. Until then, we will continue working on finding solutions for ongoing repayment transfers.

Update 14 March 2022

On Friday, we shared a standalone article in which we shared more detailed views from Mintos in relation to the recent events in the Ukraine-Russia war.

We shared a few statements from our leadership team, and addressed the state of investing in loans on Mintos in the current environment

Update 8 March 2022

Score withdrawn for SOS Credit loans, extension and interest rate updates

From 9 March, loans from Ukrainian lending company SOS Credit will be marked with SW (Score withdrawn) on the Mintos platform due to local regulation as the borrowers and the company suffer impacts of the Russian invasion of Ukraine. For investors on Mintos who have investments in SOS Credit loans, the prolongation of 30 days will be shown for these loans, and the interest rate will be changed to 0% to reflect the status with the borrowers. Information will be updated on Wednesday, 9 March 2022.

The extensions will be updated or their status will be changed according to future developments in this matter. We will inform you timely about all news regarding borrowers’ loans from this Ukrainian lending company.

We also got a statement from this Ukrainian lending company’s management, find more here.

Statement about the Eleving’s Belarus entity

Modestas Sudnius, Group CEO of Eleving Group:

“The situation in Ukraine deeply saddens us and our hearts at Eleving Group are with all those affected. Wars only know victims, on all sides. To protect the workforce and the Company, we have decided to scale back activities in Ukraine and Belarus – in line with our crisis plans – in an orderly and controlled manner. As a result of our preparations over the past weeks and months, the corresponding measures are proceeding according to plan.”

To remind you, Belarus loans represent 8% of Eleving portfolio, a lending company with lending activity across 14 geographies. Payments to investors on Mintos will not be impacted due to Eleving’s group guarantee.

Another statement from the Russian lending company: Lime Zaim

Olesya Kiseleva, Managing Director of Lime Zaim:

“Due to restrictions and sanctions against the Russian Federation, our company is facing a number of issues that potentially affect our interaction with Mintos. Be assured that we are working around the clock to resolve all issues. We treat all our investors with respect and we share your concerns. In the event of unforeseen circumstances, we ask for your understanding for the possible delays in payments. We, like many other companies, have become hostages of circumstances and, like the entire world, we are waiting and hoping that all the parties will return to dialogue and find mutual understanding. In anticipation of similar developments, the company is in discussions with Mintos representatives in order to develop acceptable solutions for all involved parties on settling our current obligations. At this time negotiations are in progress and various possible scenarios are being considered.

For our part, we do not currently detect any drastic deviations in customer demand, but there are prerequisites for a decrease in payment discipline indicators. This is panic among customers that we already experienced in 2020 during the first wave of the COVID-19 pandemic. In this regard, the company systematically tightens customer requirements to reduce the volume of originations and for larger repayments later. The country has already put forth an edict on the resumption of credit holidays for citizens with reduced incomes. We are already receiving these applications and forecasting a significant number of loan extensions. Nevertheless, we exert our best efforts to create optimal conditions for our clients to repay their debt. The company offers restructuring programs to borrowers who face difficulties due to political events. According to our estimates, these measures can help maintain the necessary level of financial stability and minimize the impact of sanctions on investor relations.

Lime-Zaim has gained experience in adapting its operating business model to crisis conditions imposed by foreign-policy and economic agenda. We have successfully overcome the 2014-2015 sanctions and the pandemic crisis and are confident in navigating new challenges. Thank you very much and keep safe.”

Visa, MasterCard, Paypal suspend activity in Russia, sanctioned banks are turning to China

- As the stock market in Russia was closed since the invasion of Ukraine started, in some way, the losses for stock market investors have been delayed. The latest information is that the Central Bank of Russia will give an update on stock market trading this Wednesday.

- Visa, Mastercard and American Express are suspending activity in the Russian market. Cards from these companies will be eligible for use within Russia until they expire, and won’t work for payments outside of the country, while cards issued in other countries won’t be usable within Russia – in stores or on ATMs.

- Fintech companies also continue suspending their activities in Russia. After Wise and Remitly, also PayPal restricted its service in Russia, allowing only withdrawals for a period of time, to allow their Russia-based customers to take out their deposits.

- Biggest Russian banks such as Alfa Bank and Sberbank have announced that they’re working to issue cards soon. The transactions would be based on the Russian system for international payments Mir, or on the Chinese payments system UnionPay.

Update 4 March 2022

The decision about introducing credit holidays in Russia is currently in progress

Today, the Russian State Duma is considering a bill enabling borrowers to request credit holidays. The bill was unanimously supported in the first reading, and the final decision should be known already today. Among other subjects of the bill, it also includes citizens whose income has decreased by 30% as a result of sanctions.

Borrowers would be able to request a grace period of up to six months, until September 30 2022, without being charged any fees.

We will share more information in future updates.

No transfer of EUR from Russia, no RUB exchange rate in the EU

Lending companies from Russia are showing serious willingness to cover their due repayments to Mintos investors. They underline that it’s also not in their interest to delay repayments, but technical obstacles are reality. Sanctions imposed on Russian banks are also met by the current Russian policy that forbids transfers of foreign currencies out of the country. Only RUB payments can be made. The largest part of Mintos’ exposure with these companies is in EUR, and funds in EUR can not be transferred outside of the Russian market.

As you’re aware, lending companies are directly or indirectly impacted by bans for sanctioned banks. These big banks are often corresponding banks for the smaller service providers. Anyhow, some lending companies have accounts in smaller banks as an alternative, and these banks can (still) find ways to transfer RUB to foreign accounts.

Yesterday, we received weekly due repayments in RUB from two lending companies. Although transferred amounts were not significant, they signal that transactions with Russia are not completely impossible. The issue on our side is that Mintos’ servicer banks simply can’t process or exchange RUB at the moment. We assure you that our teams are working nonstop to explore all alternatives or windows of opportunity for transactions and exchanges. We will share with you more about your due repayments once we have more information.

Please remember that the European Central Bank currently doesn’t have an exchange rate set for RUB, due to abnormal market conditions in which the RUB value can’t be determined due to great uncertainty and daily changes across the markets.

Statements from the lending companies in the Russian Federation

As we shared in previous updates, we are in communication with the lending companies who offer loans issued in the Russian Federation. We have business relations with 7 companies in this market: Kviku, Revo, LimeZaim, Dozarplati, Ecofinance, Creditter, and Mikro Kapital. Total exposure in investments in loans issued by these companies is currently € 60.4 million and RUB 727.5 million, which represents under 15% of the total outstanding investments on Mintos.

Other than the main issue with transfers from Russia and the completely undefined state of RUB in the EU, lending companies from Russia report that they currently see no changes in borrowers’ discipline. With impending inflation in the country, lending companies are either significantly reducing their issuance volumes to control liquidity in case of rising inflation, or they continue working as usual, relying on cash reserves and strong equity positions. All lending companies we talked to are willing to find ways to avoid additional expenses from accrued pending payments due to Mintos and investors.

We also received statements from some of the lending companies, and will be adding new ones as they arrive.

Pavel Sologub, CEO of DoZarplati

“Over the past few years, we have been working in an increased stress mode – we already have valuable experience during a pandemic and a hard lockdown, and we are successfully applying it in this situation.

We continuously monitor and respond in real-time. The dynamics of borrowers’ behavior remains unchanged, the issuance and repayment of loans are carried out as usual. Transactions are made without interruption, payment system gateways and acquiring services work without changes.

Disconnecting some banks from SWIFT will not affect ruble transactions within the country – they are still carried out without hindrance.

Our policy, as always, is to fulfill our obligations to our partners and customers, ensuring the uninterrupted operation of a reliable and affordable instant online lending service. We continue to work throughout Russia in a 24/7 format, helping people solve their financial problems.”

Nikita Lomakin, CEO of Kviku

“On 2 March, the Russian CBR introduced a temporary restriction on currency payments under loan agreements concluded with non-residents. Kviku is in direct contact with the regulator on this matter and is currently investigating available repayment options.

We continue to honor our liabilities with Mintos and are committed to restarting settlements as soon as the transfer of funds becomes available from Russia again.

Operations in Russia remain business as usual, with borrowers making payments to our local bank accounts. Issuance volumes to new POS clients have been reduced and we are currently focused on the most profitable segment of issuance – repeat clients.”

Eugene Antohov, CEO of Creditter

“We speak from the position of the need to fulfill the obligations assumed, to maintain international business relations. Since being a participant in the global market of financial organizations, whose services are used by tens of thousands of consumers, we stand on the principles of open, honest and mutually beneficial cooperation. We believe that the investments made by investors in our company will remain unchanged. At the same time, we note a possible increase in the actual repayment period of the borrowers to the lending company in connection with the measures implemented by the authorities of the Russian Federation and the Bank of Russia to support individuals – consumers of financial services, in particular within the framework of draft law No. 80712-8 approved by the State Duma of the Russian Federation in the third reading Russian Federation” borrowers will be granted the right to a grace period for using borrowed funds, similar to what was implemented during the COVID-19 pandemic. In the near future, the Bank of Russia will also present additional measures to support financial market participants, including microfinance organizations.”

Statements from the other companies will be added to this thread as we receive them.

Upcoming: Live Mintos AMA dedicated to the current state of the market

On Monday, 7 March 2022 at 16:00 CET, we will have a special AMA session to discuss topics related to the impact of the war in Ukraine and sanctions for Russia on Mintos, the state of relations with lending companies from Russia and Ukraine, and the effects on investors on Mintos.

AMA will be hosted by Martins Valters, Mintos Co-founder, COO/CFO.

In this short session, we will give our overview and address some questions from investors.

You can share your questions here, and set a reminder on the video session scheduled on the Mintos YouTube channel.

Questions with the most upvotes will be answered first. Remember to upvote posted questions in order to push them up the list.

Update 2 March 2022

News about SWIFT

Yesterday evening, European Union ambassadors agreed on the list of Russian banks that will be excluded from the SWIFT financial-messaging system. Banks such as VTB Bank PJSC and Bank Rossiya are among those facing a ban. The other institutions included on the EU list are Bank Otkritie, Novikombank, Promsvyazbank PJSC, Sovcombank PJSC, and VEB.RF.

Banned entities are corresponding banks for many other smaller banks, and lending companies from Russia are in one way or the other impacted by the SWIFT ban, directly or as other banks’ clients.

We are assessing the status of the lending companies at the moment and will share more on the alternatives in the following days. You can read more about the lending companies’ ability to transfer money in the following sections.

Lending companies technically unable to transfer repayments

We are in communication with the lending companies from Russia that have loans for investments on Mintos. You’re probably aware that money transactions to and from Russia are disrupted across various markets. Lending companies offering loans from Russia on Mintos are no exception. As we work to assess the status of all lending companies and discuss how to reduce indirect effects of the sanctions for Russia on investors on Mintos, we can already summarize a few conclusions:

- So far, lending companies had no problems with borrowers’ settlements

- At the moment, borrowers’ repayment discipline seems unchanged, but it’s not guaranteed to remain that way due to high risks of RUB inflation

- Although demand for loans in the country is growing due to the anticipated inflation and social distress, lending companies are reducing their loan issuance volumes to better control their portfolio performance

- All repayments sent to Mintos accounts from Russian lending companies have been returned by banks to senders, which means that delays in repayments to Mintos are of a technical nature and a result of sanctions for banks and measures in European countries affecting the ability/willingness of banks to receive and hold RUB

- 6 – 8 March are national holidays in Russia, and this might further influence activity on finding solutions for transfers

- Some lending companies are actively working on exploring new banks and routes for their due repayments

- Our communication with lending companies from Russia continues on a highly professional level, and we see efforts to keep the business going

- Overall, lending companies on Mintos offering loans from Russia are currently operational, future projections are subjects of day-to-day developments of the current war and sanctions.

During this week, we will share more precise information based on conversations with the lending companies, including their statements on the current status.

RUB and KZT exchange remained closed today

Currency exchange on Mintos for RUB and KZT remained closed today. As we mentioned before, we will be enabling this function in short time windows during workdays, when we have access provided by the servicer banks. At the moment, this mostly relates to KZT.

RUB becomes more and more isolated

Measures against RUB in EU banks and sanctions for Russia are further isolating this currency, with a threat of completely locking RUB within the Russian Federation in the upcoming days. This is why EU banks are continuing to liquidate RUB positions. Another servicer bank that Mintos investors’ RUB funds are held with decided to do the same, due to elevated risks of inability to move this currency across markets.

Amounts held with this bank will be exchanged to EUR and distributed proportionally to Mintos investors with funds available in RUB. Investors will be informed by email.

For investors wondering if they can make the exchange of funds available in RUB to EUR optional, we have to underline that exchange from RUB to EUR is not based on a decision of Mintos. Please, note that Mintos is not a bank, hence the company doesn’t hold investors’ available funds within the company, but we use servicer banks for deposits. Banks are making such decisions to refrain from breaching sanctions regulations, and it’s not in the domain of our control.

Impact on the Mintos business

As investors are also interested in how the war in Ukraine and sanctions for Russia impact our business, we want to share information about this.