For hundreds of years, securities have formed the basis of the investment market, and today, they’re the most common form of investing. If you’re just getting started with investing in securities, this article should help get you more familiar with them. We look at what securities are, the different types, how they’re traded, and their benefits. We also talk about the concept of Notes, which are Mintos’ upcoming asset-backed securities.

What are securities?

If we strip back a security to its most basic form, it is a legally binding contract that involves some kind of financial value, such as an asset. These contracts are called financial instruments and are usually created by governments or companies then offered to investors. Financial instruments themselves are not tangible assets you might own, like a car, home, or jewelry.

A security is simply a financial instrument that’s tradable. In other words, you need to be able to exchange it for something of monetary value.

How are securities created?

You may be thinking, why do companies and governments create securities? Well, the idea is to raise money (capital) so that these entities can continue to grow or keep up with their existing financial obligations.

The entity that creates a security is called “the issuer,” and when you purchase a security from the issuer, you’re considered the investor.

The different types of securities

At a high level, securities are split into two main types: equity and debt.

Equity securities provide ownership rights to the investor. The most well-known equity securities are stocks (or shares). When an investor buys a stock, they’re given part ownership (equity) of that company in return. Many buy them in the hope that their value will increase over time – just like when you plant the seeds for a vegetable garden and wait for them to flourish.

On the other hand, debt securities are where investors loan money to an entity and receive fixed repayments plus periodic interest in return. Popular debt securities are government bonds, where governments borrow money from investors and pay them interest for the bond’s duration. In this scenario, you’re essentially loaning funds to someone so they can plant their vegetable garden but are rewarded along the way.

In addition to these types, there are hybrid securities that are made up of both debt and equity. Typical hybrid securities we see on the investment market are things like convertible bonds, which are bonds that can be converted into stocks (of the company that issued the bond).

How securities are traded

The issuing of securities dates all the way back to medieval times when governments and companies needed financial support during times of war and instability1. Back then, people happily traded and negotiated securities privately between themselves. But as the demand for trading securities eventually grew, so did the need for organized markets. So intermediaries started to act as “middlemen” in the buying and selling of securities, resulting in the creation of stock exchanges.

Fast forward to today, and the stock market is now one of the world’s largest sources of trading activity, with multiple exchanges valued at trillions of euros. Most major “issuers” of stocks publicly list their securities on these stock exchanges. Plus, outside of stock exchanges, there are Investment Firms that issue securities “over the counter” to investors.

There’s also the secondary market, where investors can buy and sell securities between each other. These markets allow investors to sell their investments for a profit, like when there’s an increase in a stock’s value. There are thousands of platforms and apps that make secondary market trading fast and simple. However, these only cater to publicly traded securities like commodities, stocks, bonds, and cryptocurrencies.

Benefits of investing in securities

- Structure

Securities provide a way for money to move between investors and companies (or governments) in a structured way. They also remove the need for an investor to own or manage an asset physically. - Regulation & investor protection

When it comes to how securities are issued, an issuer is subject to strict controls set by regulatory organizations, which help safeguard investors. Then when it comes to selling securities (something often done by investment firms rather than issuers), national authorities ensure investors are adequately protected if an investment firm fails to meet its obligations. - Transparency

During and after a security has been offered for investment, investors are provided with clear and transparent information to help them make informed decisions. This is done through investor-friendly documents like Prospectuses and Key Information Documents. - Market efficiency

Because securities are sold within organized markets, it’s easier for investors to find investment opportunities and for companies to find investors to purchase their securities. Plus, because of the enormous amount of transactional data that goes through these major exchanges, the market value of securities ends up being quite accurate. - Tradability

Investors can easily trade securities through stock exchanges and other secondary markets through investment apps – allowing them to purchase the securities or convert their investments back into cash.

Investing in securities on Mintos

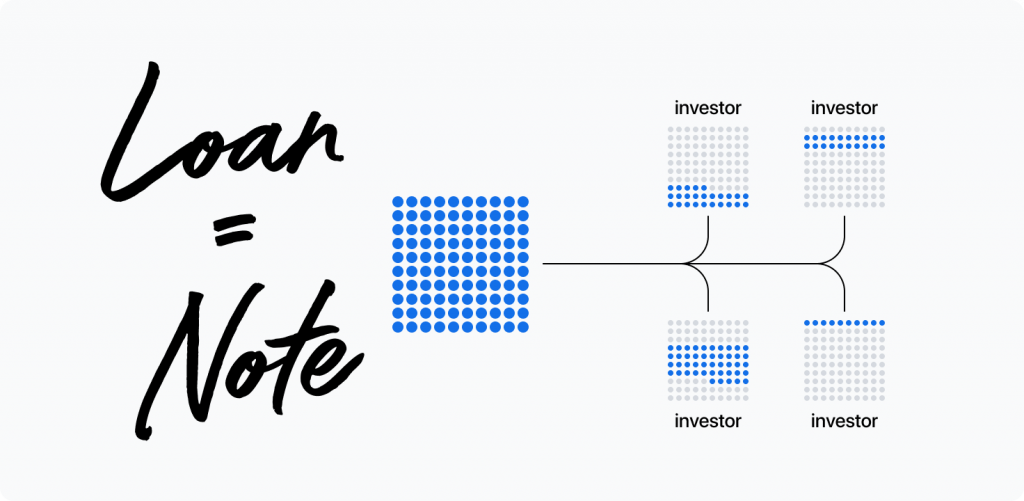

In the near future, the main form of investing on Mintos will be through financial instruments called Notes, which are asset-backed securities.

What are asset-backed securities?

The term asset-backed is used when a security’s value is based on an income-generating asset, such as cash flow from debt. When a security is based on income from a loan, for example, the value of that loan supports (backs) the security, hence the term asset-backed.

On Mintos, Notes are classified as asset-backed securities because their value is derived from the underlying loans.

Let’s look at an example of how a Set of Notes is formed in the direct structure (the most common)

- Multiple borrowers take out loans with a lending company

- The lending company pools together loan receivables2 with similar characteristics

- The lending company sells the title (rights) to this pool to the “issuer,” which in this case is a Mintos special purpose entity3

- The issuer then converts this pool of loans (ranging from 6-20 individual loans) into one Set of Notes

- The issuer then offers the Set of Notes on the Mintos platform to investors

To read more detail on how the indirect structure of Notes works, head to our blog post on Notes.

What happens when an investor buys into a Set of Notes?

- When an investor purchases into a Set of Notes, their account is debited with the purchase price, which is then transferred to the lending company

- At the same time, the Set of Notes is added to the investor’s investment account on Mintos

- From here, each time a borrower makes loan repayments together with interest, the lending company transfers these funds to the issuer, which in turn makes repayments to the relevant investors who have purchased into a Set of Notes

Benefits of investing in Notes on Mintos

Structure

Asset-backed securities provide a structured way for funds to move between lending companies and investors. Each Set of Notes will have a unique International Securities Identification Number (ISIN), provided by a securities depositary. ISIN identifiers create clarity and accuracy in the process of investing in Notes.

Regulation

Notes allow investors to invest in a fully regulated environment, where Mintos is required to comply with several laws and regulations. A combination of sound internal control mechanisms, internal and external audits, and regulatory oversight ensures Mintos strictly follows all applicable requirements.

Investor protection

Investors on Mintos will be protected by the MiFID II investor protection framework, Prospectus Regulation, Packaged retail investment and insurance products (PRIIPs), and Investor Protection Law. In addition, they’ll be protected by an investor compensation scheme established according to the requirements of EU Directive 97/9/EC.

Transparency

Investors will also have access to in-depth prospectuses and Final Terms documents covering information about potential investments in Notes, which the relevant regulatory body will approve.

Market efficiency

Because many larger lending companies prefer the structure of Notes, more lending companies are able to participate on the Mintos platform – making it even easier for investors to find lending companies needing investment capital. This results in more investment and diversification opportunities on Mintos, including loans with lower risk-return profiles.

Tradability

When it comes to investing in loans by way of Notes, the liquidity for investors doesn’t change. Although investors can’t trade Notes outside the Mintos platform, they can sell them on Mintos Secondary Market once purchased. Investors can sell their investments in Notes for a price set by themselves. Plus, if interest rates happen to be lower at one point on the Primary Market, there is a possibility that higher interest rate investments are being sold on the Secondary Market.

In a nutshell, investing in securities is a great way to have extra protection as an investor and complete transparency in a strictly regulated investing process. If you’d like to learn about how Notes will work on Mintos, take a look at our FAQs.

1 Michie R. C. (2006) The Global Securities Market: A history

2 The amounts of money owed from a borrower to a lender

3 The Issuer is a special purpose legal entity established for the purposes of:

- Purchasing Loan Receivables from the Lending Company;

- Pooling those Loan Receivables for a particular Set of Notes; and

- Issuing those Set of Notes on Mintos platform.