SECURITY

Diversification and returns

Spreading capital across multiple assets is considered one of the best ways to manage investment risk. The more diversified an investor’s portfolio is, the less they feel the impact of market events on its individual parts.

Why diversification matters

All investments come with the risk of losing the invested money. By investing in many different assets, investors can mitigate their exposure to individual investments failing: Each investment will only make up a small part of the portfolio, and losses in one area might be offset by gains in another – especially if the individual assets are less correlated. So while investment risk can never be completely eliminated, diversification is widely regarded as a key tool for reducing investment risk and earning consistent returns.Diversification on Mintos

There’s no single proven way to build a diversified portfolio. That said, some common principles from investment theory can be applied.

What this means

Holding a large enough number of assets

Investing in Notes backed by many different loans can reduce exposure to borrower defaults. This can also reduce the volatility of the portfolio and lead to more stable returns. Holding more Notes means each of them represents a smaller part of the portfolio and will have a smaller impact on the portfolio’s performance.

What this means

The portfolio includes 100 different loan parts or more.

Sufficient lending company distribution

Investing in Notes for a variety of lending companies can reduce exposure to the credit risk of each lending company.

What this means

Underlying loans for any 5 lending companies should make up no more than a combined 50% of the portfolio.

Avoiding single company concentration

Concentration of investments in Notes for a single lending company could increase exposure to the credit risk of that company.

What this means

Underlying loans for one lending company should not make up more than 20% of the portfolio.

Sufficient distribution across countries

Diversifying across geographies can reduce exposure to unexpected geopolitical or economic events.

What this means

Underlying loans from any 3 countries should make up no more than a combined 50% of the portfolio.

Avoiding single country concentration

Concentration of investments from a single country could increase your exposure to unexpected geopolitical or economic events.

What this means

Underlying loans from any one country should make up no more than 33% of the portfolio.

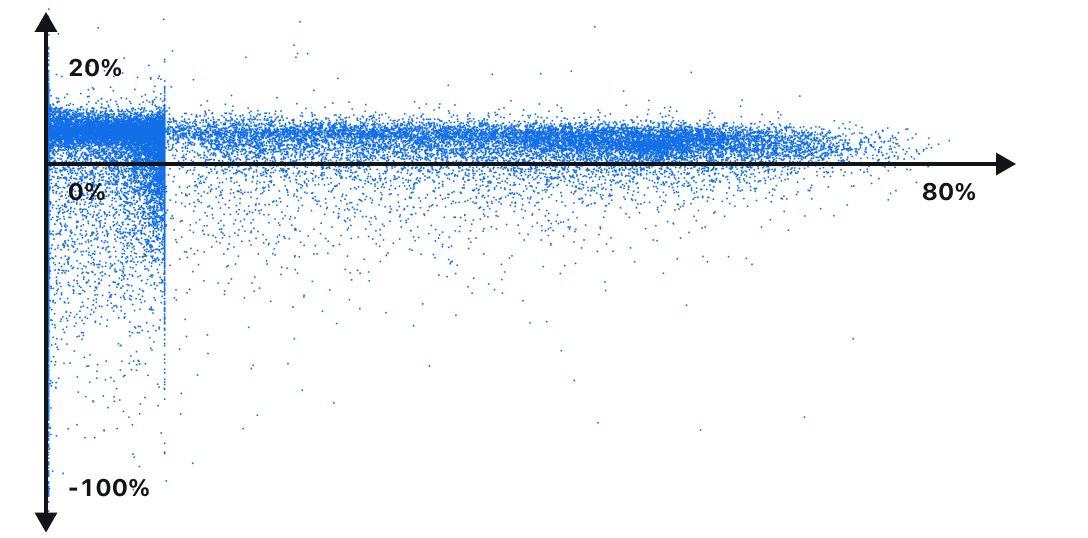

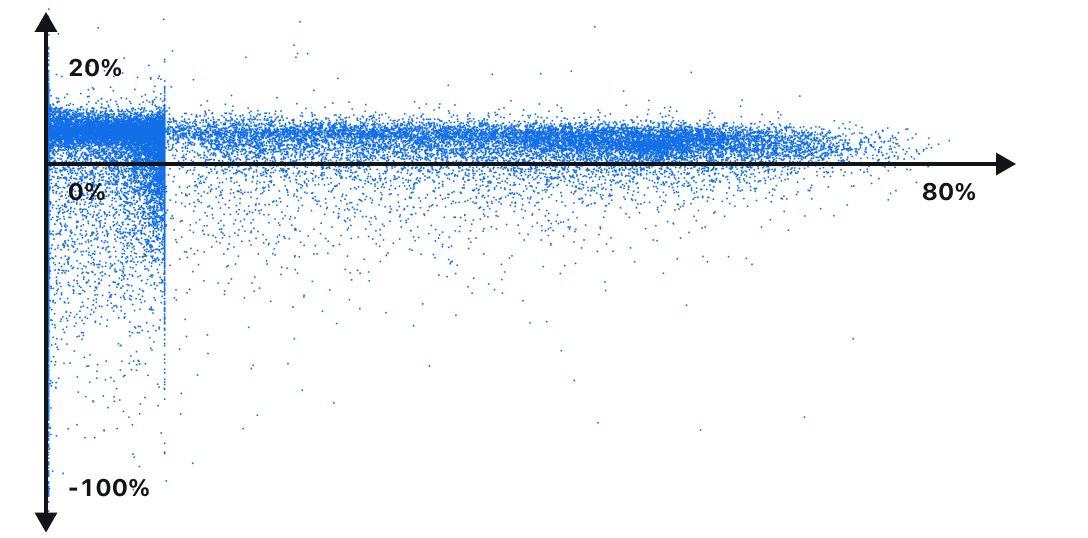

Diversification and return

Diversification revolves around the understanding that some assets will perform better than others, but investors don’t know in advance which ones. The return on a diversified portfolio will always be lower than the highest-performing investment. Conversely, it will also always be higher than the lowest-performing investment. That means more diversified investors will have on average more stable returns and fewer negative outliers.¹

Net Annual Return

Diversification

Learn more about security on Mintos

Managing investment risk

The risks you face on Mintos, and what you can do about them

Mintos Risk Score

What is the Mintos Risk Score and how it can help you make investing decisions

Mintos and your data

How Mintos handles and protects your data, and puts you in control

Protect your account

How you can help protect your account against unauthorized access